Services News Team Contact CSR-Blueprint (PDF - Publication in German)

Corporate Social Responsibility (CSR), Sustainability, Environmental Social Governance (ESG). Many terms – one meaning: Change affecting almost all areas of an enterprise. From carbon footprint and new reporting obligations to diversity and integration to supply chain due diligence and the use of clean technologies.

Doing the right thing now for a better tomorrow: the global Baker Tilly slogan “Now, for tomorrow” is the perfect headline for our Competence Center Sustainability.

The former “nice-to-have” and recipe for success for occupying individual niches has long since become a general entrepreneurial imperative. For entrepreneurs, responsibility no longer applies only to profitability, but also to the environment, society and their own employees.

Changing values, new legal requirements and criteria, some of which are already in place and some of which have yet to be defined in a binding manner by institutions and legislators, are setting the direction here, calling for integrated transformation concepts.

Interdisciplinary expertise and know-how to implement your sustainability targets

Our Competence Center Sustainability combines the expertise and know-how of our auditors, tax advisors, lawyers and business consultants from various areas and industry teams. Thus, we jointly develop comprehensive, interdisciplinary solutions for your sustainability targets – solutions you can trust, and which serve as basis for a successful business future.

Non-financial reporting: CSR blueprint for your sustainability reporting

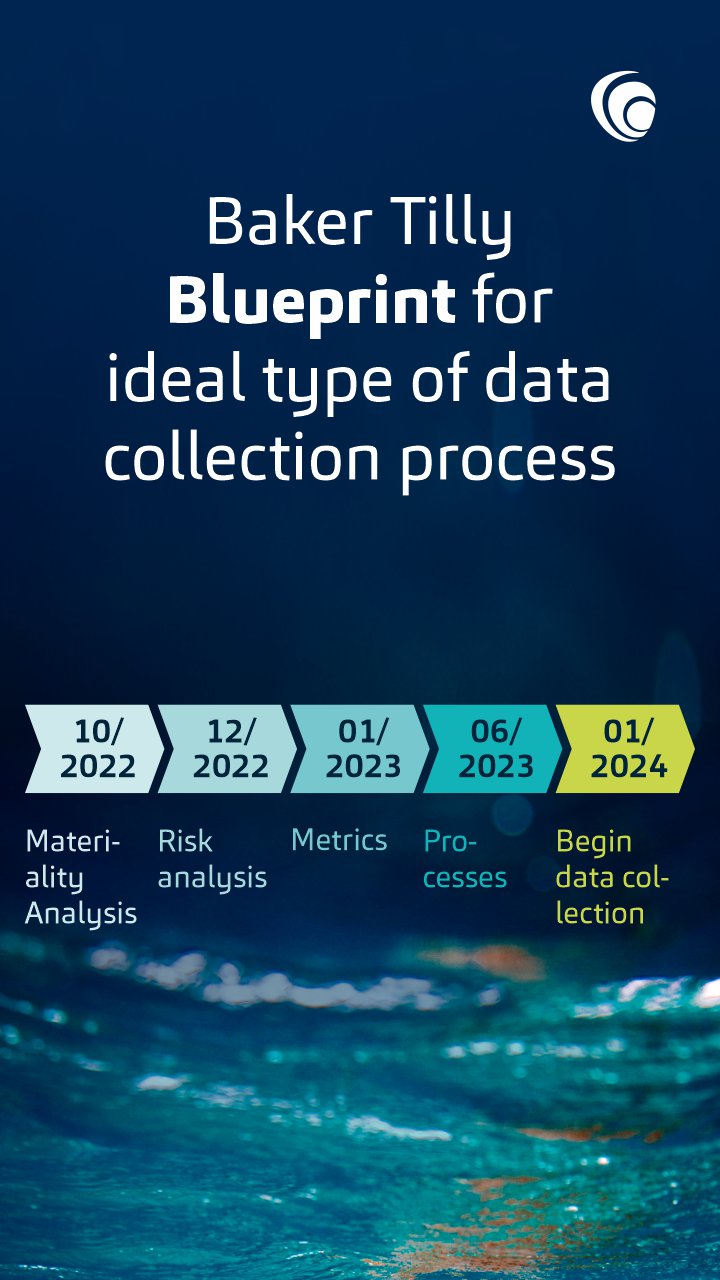

In times of constant change, sustainable management is gaining more and more importance and is becoming a real success factor. Based on previous experience, Baker Tilly has developed an ideal type of data collection process. Such process can be used as a blueprint for the development of sustainability reporting.

Corporate sustainability responsibility (CSR) is not only a challenge, but also an opportunity for companies. In particular on the capital market, transparent communication about the impact on the environment and society is becoming increasingly important. Especially for long-term oriented investors, the ESG aspects of activity are highly relevant for evaluating the extent to which the business model is justifiable and profitable in the future.

Our services related to the topic of sustainability

In a time of constant change, sustainable corporate governance is becoming increasingly important and is developing into a true success factor. In order to achieve this, companies must place a strong focus on ESG criteria and their CSR strategies, as well as the transformation towards a sustainably positioned company.

Our experts support you in developing an overarching strategy for the modification of existing and the implementation of new ESG processes and systems. You receive a reliable overview of your company’s entire ESG obligations. For the transformation, we conduct materiality analyses, develop key performance indicators with you and help create the data basis for your reports.

- Inventory

- ESG readiness check

- Determination of key sustainability aspects

- Report preparation process

- Advice on meeting ESG reporting requirements

- Maturity level / improvement potential of reporting systems

- Selection and implementation of current and new sustainability standards

- Optimization of ESG processes, data flows and transparency

- Compliance

- Benchmarking of the ICS with regard to sustainability information

- Implementation of appropriate internal control systems

- Integration of sustainability aspects in risk management systems

Perhaps you already trust us in the preparation of your annual financial statements. We would also be happy to support you in the preparation of your non-financial reporting. In this context, we draw on the expertise of all Baker Tilly disciplines.

In doing so, we follow the tried-and-tested Baker Tilly ESG model approach for the preparation of sustainability reports or in defining and compiling the necessary information:

- Materiality analyses and identification of key stakeholders

- Definition of key objectives and identification of key risks

- Selection and development of key performance indicators (KPIs)

- Data collection

- Definition of measures

This gives you the assurance of comprehensive ESG/CSR reporting that meets all regulatory requirements.

Christian P.

Roos

Partner

German CPA

Eugenie

Schmidt-Hane

Director

German CPA

Marcus

Carius

Director

German CPA, Certified Tax Advisor

According to the current draft directive on the revision of the CSR Directive, large companies will also be required for the first time to increasingly report on sustainability in the management report for the 2023 financial year. Small capital market-oriented companies will have to report for the first time in the management report for the 2026 financial year.

The inclusion of the information in the management report also raises the question of an audit of this information. After all, the auditor also confirms the management report’s compliance with legal requirements with his audit certificate. But how does the auditor ensure his audit reliability in this new audit area, or what requirements must a company's documentation meet in order to continue to receive an unqualified audit opinion for the annual financial statements?

Clarification of the audit requirement for non-financial information

Sustainability reports and non-financial statements are currently not subject to a substantive audit requirement by an auditor, who is only required to check that they are submitted in due time and, if necessary, to check the reference in the management report to the place of publication (Art. 317 (2) sentence 4 HGB (German Commercial Code)).

With the introduction of the revised regulations on non-financial reporting, the audit obligation will change as well. Whereas the auditing duty for capital market-oriented companies with more than 500 employees currently lies with the Supervisory Board (Art. 171 (1) sentence 4 AktG (German Stock Corporation Act), the introduction of the new regulations on non-financial information in the management report requires the auditor to audit this information. On the basis of the – in contrast to the preparation process – little concretized auditing standards, the auditor is transitionally granted limited assurance for the audit of this information.

Documentation requirements according to the currently existing audit standards

Currently, ISAE 3000 on the audit of information other than historical financial information is the authoritative auditing standard. The standard setters are working at full speed on new auditing standards tailored to sustainability reporting. In principle, it can already be stated that the auditor's risk-oriented audit approach will be retained, so that a company to be audited must be prepared for the following audit procedures.

- Audit of the internal control system: documentation + implementation + controls

- Double materiality: documentation on completeness and relevance of non-financial information for shareholders and stakeholders

- Case-by-case examination: Evidence check on the data basis of key figures, accuracy of measurement procedures as well as on estimated values

- Analytical audit procedures

- Structured reconciliation of business activities with the taxonomy

In order to prepare for the new requirements, it is advisable to consult with your responsible auditor in good time. In this context, our services include the audit ...

- of processes for data collection of non-financial information

- of non-financial statements

- of sustainability reports

- according to ISAE 3000

For further information on our general audit services, please click here >>

Christian P.

Roos

Partner

German CPA

Eugenie

Schmidt-Hane

Director

German CPA

Marcus

Carius

Director

German CPA, Certified Tax Advisor

The German Supply Chain Due Diligence Act (Lieferkettenorgfaltspflichtengesetz) is of particular importance for the planning and implementation of a sustainable supply chain.

The law was passed by the German parliament on June 11, 2021 and is intended to ensure compliance with due diligence requirements relating to human rights and environmental protection in corporate supply chains.

For which industries and companies is there a need for action? Which due diligence obligations must be observed and how can these be implemented in practice? We explore these questions on our focus page on the Supply Chain Act.

Sebastian

Billig

Partner

Attorney-at-Law (Rechtsanwalt)

Oliver

Köster, LL.M.

Partner

Attorney-at-Law (Rechtsanwalt)

Sustainable financing solutions / instruments

Our experts advise you on all topics relating to sustainable financing. We show you how you can benefit from a sustainable financing structure in the long term.

Sustainable Finance refers to financing activities relating to both mitigating and preventing environmental and climate damage (E), promoting social action (S) and sustainable corporate governance (G).

The basis is the Paris Agreement and the EU Action Plan. On May 5, 2021, the German Federal Cabinet adopted Germany's first Sustainable Finance Strategy. The strategy aims to mobilize urgently needed investments for climate protection and sustainability and at the same time addresses the increasing climate risks for the financial system.

The guidelines on lending and credit monitoring issued by the European Banking Authority (EBA) require an appropriate consideration of ESG aspects. This necessitates a comprehensive quality campaign and review of processes in new lending and existing business at the banks. In the meantime, the banks' internal rating systems are being successively expanded to include ESG factors and will be given greater weight in the lending decision process in future.

Sustainable financing solutions/instruments can be divided into two categories: earmarked ESG financing and ESG-linked financing. Earmarked ESG financing is characterized by a narrowly defined purpose for the financing funds. ESG-linked financing, on the other hand, defines KPIs and ambitious SPTs ("Sustainability Performance Targets") which, in case of a corresponding under- or overperformance, are accompanied by a positive or negative change in the margin. In particular, external ESG ratings are used in order to measure ESG performance.

Our experts help you select the right sustainable financing solutions/instruments at an early stage, accompany you as your personal “sparring partner” in discussions with financing partners, and ultimately find a tailored, sustainable financing structure that matches your business model and strategy.

For more information on corporate finance, please visit the pages of our Debt Advisory Competence Center.

Markus

Paffenholz

Partner, Head of Debt Advisory

EU Disclosure Regulation and EU Taxonomy Regulation

Our experts advise you on the implementation of the EU Disclosure Regulation and the EU Taxonomy Regulation’s requirements.

ESG regulation of the financial industry is progressing rapidly. The ESG regulation’s cornerstone is the Action Plan on Financing Sustainable Growth adopted by the EU Commission in March 2018. The plan’s objective is to mobilize capital in the financial market for sustainable investments and to direct capital flows to sustainable projects. The plan's measures also include the introduction of a taxonomy (EU Taxonomy Regulation), the expansion of ESG reporting requirements (EU Disclosure Regulation), and the inclusion of sustainability in investment advice (amendments to the Delegated Acts under MiFID II). We advise financial market participants, such as capital management companies and investment funds, on the implementation of these regulatory requirements.

The EU Disclosure Regulation and the EU Taxonomy Regulation result in a number of disclosure requirements in the sales prospectuses, on the website and in the annual reports. Our experts are familiar with the complex requirements arising from the extensive legislative materials. We support you in implementing the reporting requirements in your internal processes. Alternatively, as auditors of financial market participants’ annual accounts, we audit the implementation of the legal requirements in accordance with the requirements of IDW Practice Note 2/2021 “Audit of Compliance with the Requirements under Articles 3 to 13 of Regulation (EU) 2019/2088 (Disclosure Regulation) and Articles 5 to 7 of Regulation (EU) 2020/852 (Taxonomy Regulation)”.

Due to the importance of these legal regulations in the area of ESG, it is important that capital management companies and funds prepare themselves at an early stage for the new regulations, which will only come into force gradually. In this context, we also advise you on all ESG aspects in fund design and explain how funds must be designed so that they may still be distributed to investors with sustainability preferences after the changes in MiFID II.

Dr. Christian

Reibis

Partner

German CPA, Certified Tax Advisor

In an ESG (Environment, Social, Governance) due diligence as part of our integrated transaction advisory services – but also as stand-alone service – we support and advise you in the identification of relevant ESG risks in the context of company acquisitions and sales. Environmental, social or organizational aspects can have a significant impact on the accuracy of the target’s valuation.

Together with you, we determine the scope of the review, the individual review focus areas, and the substantial KPIs that are particularly important for the transaction at hand. Along this agreed catalog, we review the target company’s ESG situation including already existing ESG policies, practices and experiences and present the potential negative impacts and financial, tax and/or legal risks resulting from the review in a corresponding ESG report. To the extent we also advise you on the drafting of the corresponding transaction agreements, we implement in these agreements our findings in the form of risk-adequate guarantee and indemnification provisions in consultation with you.

We also conduct corresponding ESG due diligence investigations if you are planning to raise large-volume financing and want to professionalize and facilitate the process by providing corresponding ESG due diligence reports (vendor due diligence).

For more information on our transaction services, please visit the pages of our Transactions Competence Center.

Oliver

Köster, LL.M.

Partner

Attorney-at-Law (Rechtsanwalt)

Bernhard

Rehbein

Partner

Attorney-at-Law

Frank

Stahl

German CPA, Certified Tax Advisor

The socio-political trend toward greater sustainability and compliance with ESG criteria in the economy is also further increasing the demands on the exemplary role of the public sector in awarding contracts in an environmentally friendly and socially responsible manner.

The public sector, which is committed to the common good, has a special responsibility to protect the environment and to comply with social criteria. This obligation is also reflected in construction, supply and service contracts. In the meantime, European and German public procurement law has developed a differentiated system of regulations which enables, and in some cases even mandatorily requires, to take environmental and social aspects into account when awarding public contracts.

We will be glad to advise you on the relevant legal requirements for all stages of a procurement procedure, on the possibilities but also the limits of sustainable procurement, and on existing special regulations and available information for individual products or services such as IT equipment. This includes, for example,

- the specific meaning of the strategic award purposes of quality, innovation, and the social and environmental aspects of Art. 97 (3) of the German Act Against Restraints on Competition (“GWB”)

- the mandatory new regulations on environmentally friendly procurement in the German Closed Substance Cycle Waste Management Act (“KrWG”), in the Federal Climate Protection Act (“KSG”) and in the General Administrative Regulation on the Procurement of Energy-Efficient Services (“AVV-EnEff”) already at the level of the determination of requirements

- the admissibility of a product-specific and thus company-specific invitation to tender for the implementation of specific environmental aspects

- the reference to environmental quality labels such as the "Blue Angel" or the use of functional or performance requirements in the specifications (so-called functional tendering)

- the possibilities of negotiated procedures to take advantage of the market's environmental innovative power

- the definition of specific suitability criteria related to the environmental aspects of the subject-matter of the contract

- the importance of environmental management systems, e.g., EMAS registration, in the context of the suitability criteria

- the consideration of environmental aspects as an award criterion when determining the most economical bid in accordance with Art. 127 (1) Sentence 4 of the GWB

- the admissibility and limits of ecologically justified contract conditions in the performance of a contract pursuant to Art. 128 (2) sentence 3 GWB

- the still largely unclear impact of the new Supply Chain Sourcing Obligations Act (“LkSG”) on the procurement process, including its applicability to public corporations or the future significance of the suitability criterion of "supply chain management and supply chain monitoring system" in Art. 46 (3) no. 4 of the German Public Procurement Regulation (“VgV”)

- to make the award of public contracts not only ecologically but also socially responsible

Further information on our services relating to public procurement law is available here >>

Dr. Christian

Teuber

Partner

Attorney-at-Law (Rechtsanwalt), Specialist Lawyer for Public Procurement Law

Comprehensive sustainability services with a special industry focus

Sustainable Energy aims to meet the energy needs of the present without negatively impacting the ability of future generations to meet demand.

Generally, all renewable energy sources can be classified as sustainable energy generation. Conventional generation using coal, oil and gas, on the other hand, is not sustainable because these energy sources are finite.

- For us, sustainable energy offers the opportunity to reduce the cost of energy procurement and address the current price volatility.

- For us, sustainable energy offers the opportunity to achieve decarbonization targets.

- For us, sustainable energy offers the opportunity to contribute to future energy supply.

We regularly accompany projects in the field of renewable power and heat generation.

- Construction and expansion of heating networks

- Implementation of self-supply, leasing and contracting models with renewable energy plants

- Support for investors, municipalities and/or public utilities in the construction of renewable energy plants within or outside the funding regime under the German Renewable Energies Act (“EEG”)

- Electricity procurement via Green PPAs

For more information on our services for the energy industry, please visit the pages of our Industry Team Energy & Utilities as well as the Energy Law section.

Dr. Steffen

Knepper

Attorney-at-Law (Rechtsanwalt)